Contents:

The asset turnover ratio tends to be higher for companies in certain ()sectors than in others. Retail and ()consumer staples, for example, have relatively small asset bases but have high sales volume – thus, they have the highest average asset turnover ratio. Conversely, firms in sectors such as ()utilities and ()real estate have large asset bases and low asset turnover.

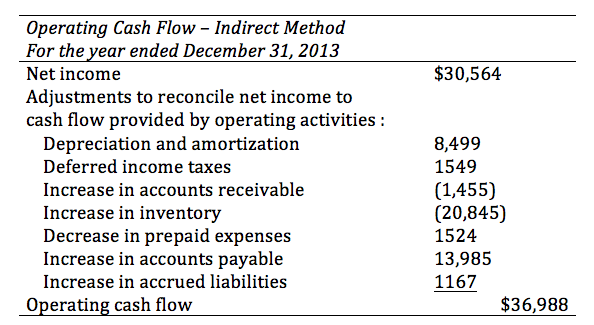

It may also suggest that a company is worried about future profitability and is accumulating a protective capital cushion. Remember total assets is also the sum of its ()total liabilities and ()shareholder’s equity. Both of these types of financing are used to fund the operations of the company. Since a company’s assets are either funded by debt or equity, some analysts and investors disregard the cost of acquiring the asset by adding back ()interest expense in the formula for ROA. In other words, the impact of taking more debt is negated by adding back the cost of borrowing to the ()net income, and using the average assets in a given period as the denominator.

Within an income statement, you’ll find all revenue and expense accounts for a set period. Accountants create income statements using trial balances from any two points in time. While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. An income statement tallies income and expenses; a balance sheet, on the other hand, records assets, liabilities, and equity.

The difference between horizontal and vertical analysis

Download our free course flowchart to determine which best aligns with your goals. In addition to helping you determine your company’s current financial health, this understanding can help you predict future opportunities, decide on business strategy, and create meaningful goals for your team. The proportion of fixed assets and current assets to the total assets is 13.60%.

Instead, this section discusses graphical analysis of common-size statements. Learning how to read and understand an income statement can enable you to make more informed decisions about a company, whether it’s your own, your employer, or a potential investment. A total of $560 million in selling and operating expenses, and $293 million in general and administrative expenses, were subtracted from that profit, leaving an operating income of $765 million. To this, additional gains were added and losses were subtracted, including $257 million in income tax.

Why Is It Called a Vertical Analysis?

This is because unlike other fundamentals such as ()return on equity , which only analyzes profitability related to a company’s common equity, ROCE considers debt and other liabilities as well. This provides a better indication of financial performance for companies with significant debt. Return on equity is a measure of financial performance calculated by dividing ()net income by ()shareholders’ equity. Because shareholders’ equity is equal to a company’s assets minus its debt, ROE could be thought of as the return on net assets.

When a https://1investing.in/‘s interest coverage ratio is 1.5 or lower, its ability to meet interest expenses may be questionable. If a lot of debt is used to finance growth, a company could potentially generate more earnings than it would have without that financing. If leverage increases earnings by a greater amount than the debt’s cost , then shareholders should expect to benefit. However, if the cost of debt financing outweighs the increased income generated, share values may decline. Debt ratios can be used to determine the overall level of financial risk a company and its shareholders face.

Know Your Business: Company Financial Statement Analysis

Combine your incremental cost findings with horizontal analysis results to gain a better understanding of the company’s financial health and trends, and to identify potential opportunities or threats. Vertical analysis is a financial statement analysis technique that shows how each line item on a company’s income statement or balance sheet compares to a base figure. Unsurprisingly, vertical analysis is often contrasted with horizontal analysis. As we’ve already established, vertical analysis involves working through your finance sheet line-by-line in order to compare your entries to one base figure.

The year of comparison for horizontal analysis is analysed for dollar and percent changes against the base year. When performing vertical analysis each of the primary statements that make up the financial statements is typically viewed exclusive of the other. This means it is atypical to compare line items on the income statement as a percentage of gross income.

What we don’t know, and what we can’t know from the vertical analysis, is why that is happening. The vertical analysis raises these questions, but it cannot give us the answers. The vertical analysis also shows that in years one and two, the company’s product cost 30% and 29% of sales, respectively, to produce. First, we can see that the company’s marketing expenses increased not just in dollar terms, but also as a percentage of sales.

- Depending on which accounting period an analyst starts from, and how many accounting periods are chosen, the current period can be made to appear unusually good or bad.

- What makes a current ratio “good” or “bad” often depends on how it is changing.

- For example, if total revenue is the base figure and net income is $100,000, then net income would represent 10% of total revenue.

- Then, calculate the percentage of each individual expense line and income category relative to the total net sales.

- You conduct vertical analysis on a balance sheet to determine trends and identify potential problems.

- A company that needs advance payments or allows only 30 days to the customers for payment will be in a better liquidity position than the one that gives 90 days.

They may be prepared for the balance sheet as well as the profit and loss statement. Two of the most common tools of common-size analysis are trend analysis of common-size statements and graphical analysis. The trend analysis of common-size statements is similar to that of comparative statements discussed under vertical analysis. It is not illustrated here because the only difference is the substitution of common-size percents for trend percents.

Preparation of Common Size Statement of Profit & Loss

This helps in understanding the composition of assets, liabilities, and equity, and aids in assessing the overall financial position of the company. It makes it easier to compare line items between periods or between companies by expressing each item as a percentage of the same base figure. By using vertical analysis, investors and analysts can more easily identify trends in financial performance, while managers can more easily compare budgeted performance with actual performance. If a company’s inventory is $100,000 and its total assets are $400,000 the inventory will be expressed as 25% ($100,000 divided by $400,000). If cash is $8,000 then it will be presented as 2%($8,000 divided by $400,000). If the accounts payable are $88,000 they will be restated as 22% ($88,000 divided by $400,000).

They can use them internally to examine issues such as employee performance, the efficiency of operations and credit policies. They can use them externally to examine potential investments and the creditworthiness of borrowers, amongst other things. Once you know what time period to focus on, you need to choose the documents and values you want to analyze. For example, you could choose to study the contribution of each revenue stream to the total amount of revenue using the information from the balance sheet. Find out a little more about vertical analysis in accounting, including horizontal analysis vs. vertical analysis, with our comprehensive article.

Income Statement: Definition, Uses, Example – Business Insider

Income Statement: Definition, Uses, Example.

Posted: Wed, 27 Jul 2022 07:00:00 GMT [source]

Vertical analysis compares line items within a statement in the current year. This can help a business to know how much of one item is contributing to overall operations. For example, a business may want to know how much inventory contributes to total assets.

EBITDA is sometimes used as a proxy for ()operating cash flow, because it excludes non-cash expenses, such as depreciation. That’s because it does not adjust for any increase in ()working capital or account for capital expenditure that is needed to support production and maintain a company’s asset base – as operating cash flow does. A common-size balance sheet is also a balance sheet containing figures from two accounting periods to which the vertical analysis has been applied. The short-term financial position of Y Ltd. is better when compared to X Ltd. The current liabilities of Y Ltd. are 6.67% of the total funds invested, whereas the proportion of current assets in these firms is 46.67%.

But taking the time to learn about financial statements, such as an income statement, can go far in helping you advance your career. While vertical analysis can provide valuable insights into a company’s financial health, relying solely on this method may not provide a complete picture. Complementing vertical analysis with other techniques like horizontal analysis and financial ratio analysis can help to better understand and interpret the company’s financial performance, trends, and position. Examine the percentages calculated in the previous step to identify trends or significant changes across periods.

How Vertical Analysis Works

Analysis of the balance sheet can take many forms, with vertical analysis just one of them. Vertical analysis can provide business owners and CFOs with valuable information, particularly when used with additional financial ratio analysis. While vertical analysis cannot answer why changes have taken place, it’s a useful tool for trend analysis along with pinpointing areas that need further investigation. Vertical analysis simplifies the correlation between single items on a balance sheet and the bottom line, as they are expressed in a percentage. A company’s management can use the percentages to set goals and threshold limits.

Comparing these numbers to historical figures can help you spot sudden shifts. Some sources define the debt ratio as total ()liabilities divided by total assets. This reflects a certain ambiguity between the terms “debt” and “liabilities” that depends on the circumstance. The ()debt-to-()equity ratio, for example, is closely related to and more common than the debt ratio, but uses total liabilities in the numerator. For example, year 2008’s current assets percentage of 48.3% is computed by dividing the current assets amount of $550,000 with the base item of total assets of $1,139,500.

- Vertical analysis expresses each amount on a financial statement as a percentage of another amount.

- A Horizontal Analysis allows you to analyze financial statements to identify historical trends.

- To this, additional gains were added and losses were subtracted, including $257 million in income tax.

- Large corporations, however, may often have both high interest coverage ratios and very large borrowings.

Though a useful tool on its own, vertical analysis can be a more useful tool when used in conjunction with horizontal analysis. It is a relatively more potent tool than horizontal analysis, which shows the corresponding changes in the finances of a particular unit/ account/department over a certain period of time. Comparing such companies with those that have a high proportion of credit sales also does not usually indicate much of importance.

For example, during the recession of 2008, car sales dropped substantially, hurting the auto manufacturing industry. A workers’ strike is another example of an unexpected event that may hurt interest coverage ratios. Businesses may often survive for a very long time while only paying off their interest payments and not the debt itself.